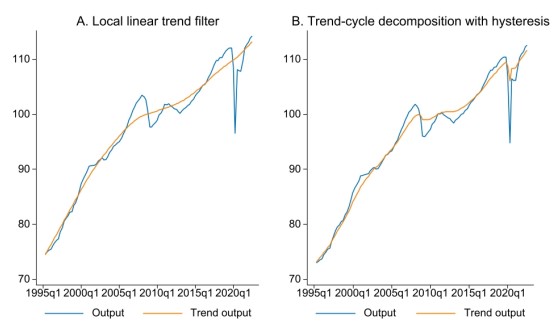

In the paper "Trend-cycle decomposition with hysteresis" we argued that the clean separation between the trend and the cycle is not a convenient assumption. As a case in point, the COVID-19 pandemic led to both a fall in supply by disrupting supply chains and it also dampened the demand in some sectors that were not directly affected by mobility restrictions. Thus, we proposed a simple addition to an otherwise common local linear trend to capture these joint supply-demand shocks. This gives as a result a trend cycle decomposition with a trend that can break in the presence of extreme events or economic crisis if they are prolonged enough to damage the production capacity, such as the GFC. The paper also provides insights to some historical periods such as the gilded age, and the 1929 crisis.

You can find the paper here.

You can also find the estimated output gaps here.

These estimates are available in quarterly frequency for 81 economies from 1995 onwards. They are also available in annual frequency for 184 economies from 1975 onwards.

Dynare codes for replication can also be found here.

We hope you find the data useful and please quote us if you use this data.

Comparison of the Local Linear Trend filter and the trend-cycle decomposition with hysteresis, US, 1995-2022

Comparison of the Local Linear Trend filter and the trend-cycle decomposition with hysteresis, Euro Area, 1995-2022

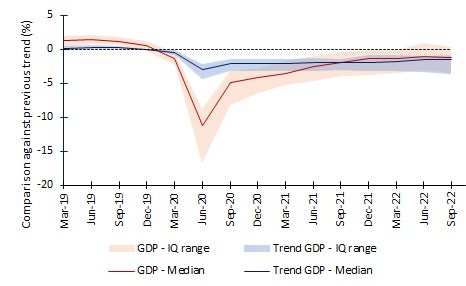

Comparison of trend GDP and GDP during the COVID-19 crisis, all economies.