Academic research

I'm currently working on the following projects:

Hysteresis elasticities: Evidence from high and middle income economies.

Abstract

Macroeconomics has long assumed that demand shocks do not affect the potential output. This study uses a Bayesian bivariate Kalman filter to estimate the hysteresis elasticities for potential GDP and the NAIRU for 73 economies. It also estimates these elasticities using a simple New-Keynesian model for 28 economies. The main finding suggests that these hysteresis elasticities are high in most economies studied. The latter implies that demand and monetary policy shocks could have long-run effects on potential GDP and the NAIRU, which firmly rejects the natural rate hypothesis. In addition, the study explores cross-country differences and finds evidence supporting the insiders-outsiders explanation of unemployment hysteresis. Similarly, it finds evidence supporting the endogenous TFP theory as a relevant source of GDP hysteresis.

Nice graphs from the paper

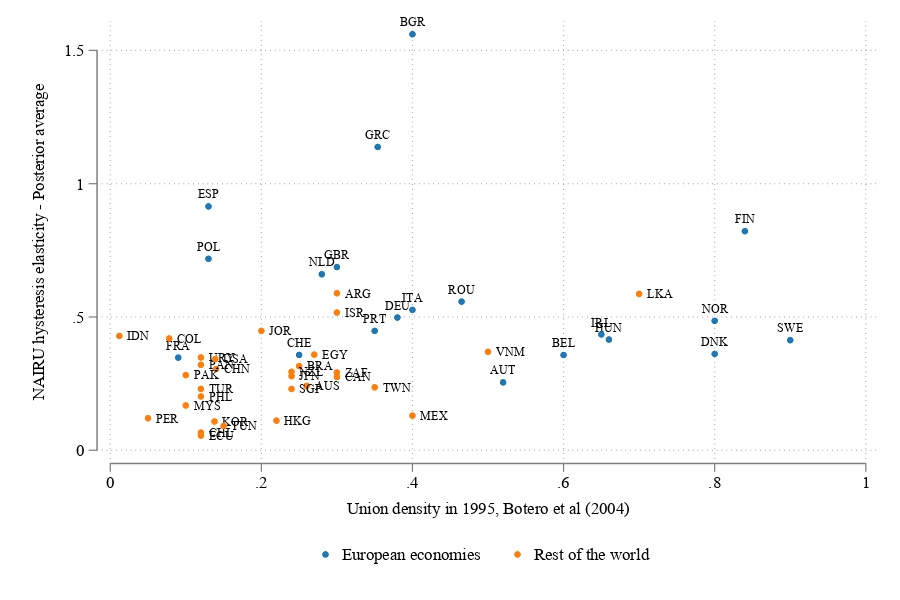

Insiders-outsider related variables and the NAIRU hysteresis elasticity

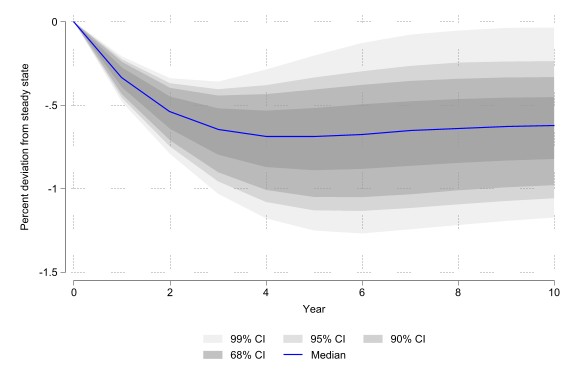

Monetary policy has important effects in the long-run - United States.

PDF

A trend cycle decomposition with hysteresis (joint with Javier Gómez-Pineda).

Abstract

Business fluctuations can be estimated as the product of perturbations that do not need to be broken down into supply and demand shocks. Joint supply and demand (S&D) shocks can help estimate the cycle in the output gap as well as a cycle in trend output. The model is a univariate trend-cycle decomposition with hysteresis in trend output, that enables the estimation of the output gap and trend output in 81 economies in quarterly frequency, since 1995Q1; and 184 economies in yearly frequency, in several cases since 1950, and in a few cases since 1820. Volatility and dispersion, as well as the frequency of large joint trend-cycle shocks, were low during the Gilded Age period; high during the interwar period, even more so in advanced (AD) economies compared to emerging market and developing economies (EMDE); and low in AD economies and high in EMDE economies in the post WWII period. In contrast with other existing estimates of trend output, those from the trend-cycle decomposition with hysteresis do not evolve smoothly, do not result in an artificial boom before recessions and are less sensitive to new data.

PDF

Spillovers de la política monetaria no convencional de los países avanzados hacia América Latina. (Master Thesis)

Abstract

In this paper, I estimate the effects of unconventional monetary policies from the

United States, Euro Area, United Kingdom, and Japan (advanced economies) on

Mexico, Brazil, Colombia, Chile, and Peru using a global projection model with shadow

rates. I found that spillovers are small and the most relevant come from the United

States. I also found that volatility spillovers from advanced economies’ unconventional

monetary policies are negligible. Historical decomposition exercises show that the most

affected variables by spillovers are the real exchange rate and inflation. Finally, I also

simulate counterfactual scenarios in which there were no unconventional monetary

policies from advanced economies past 2008, and I found that Latin American economies

would have had GDP losses close to 0.5% and inflation 1.5% lower at the end of 2014.

This shows the high costs of not implementing these policies and these results are

relevant to the COVID-19 crisis.

Some nice graphs from the paper

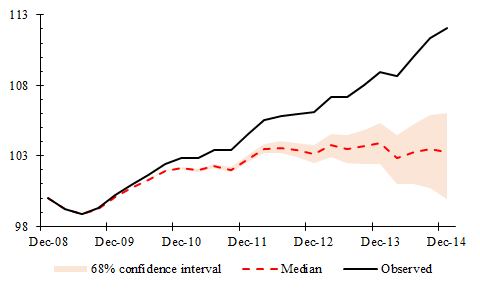

A massive GDP loss in the US if no UMP were actioned.

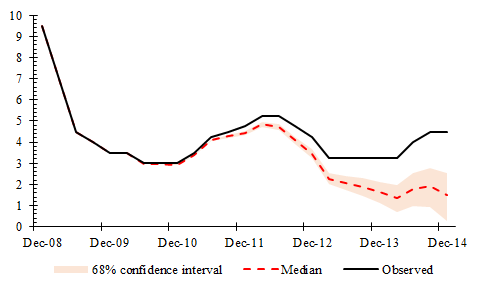

A significantly lower monetary policy rate in Colombia in the absence of Fed's UMP.

PDF

Policy relevant documents

I've also worked as a consultant and here I present some policy relevant documents I've participated.

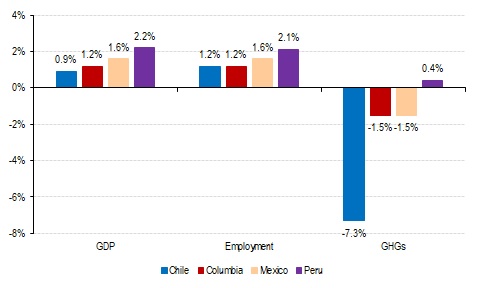

Modelamiento de los efectos macroeconómicos de la transición a la economía circular en América Latina: Los casos de Chile, Colombia, México y el Perú (Client: CEPAL)

Abstract

One of the objectives of the circular economy is to introduce efficiencies in production and consumption processes to reduce the extraction of materials from nature and avoid negative consequences on ecosystems. The greater insertion of the circular economy can not only have effects on the environment but could also contribute to the achievement of economic objectives. This study aims to present a proposal for modeling the macroeconomic effects of the circular economy in Latin America. The Pacific Alliance countries are used as case studies to estimate the effects of the increased insertion of the circular economy on GDP, employment, imports, and greenhouse gas emissions. The results of the simulations show that, in all cases, the effect on GDP and employment is positive and increasing, and that, in general terms, greenhouse gas emissions are reduced.

A nice graph from the paper

Circular economy measures can boost GDP and employment while reducing GHGs emmisions.

PDF

Evaluación del programa 40.000 primeros empleos (Client: DNP-Colombia)

Abstract

Between 2015 and 2018, the 40 thousand first jobs program created by the Colombian National Government operated, which consisted of economic support for companies equivalent to at least 50% of the labor costs derived from hiring young people (18 to 28 years old) for up to one year with little or no work experience. This study conducted an evaluation of the program's results and impact using qualitative and quantitative methodologies. The results of the study show that the program had a positive impact on the level of formal employability of young people after completing the program.

PDF